By Jill Bilich

We’ve all seen that person at work. They may sit right next to you or across the room, but no matter where they are in the office, you can just tell they shouldn’t be there today. Their entire face is showing a lack of life, they may appear a bit disheveled, and their operating speed is significantly slower than normal. You think hard before passing anything important their way because everything they touch as they go through the regular motions of the day seems to be tainted a bit. You assume they must have come down with some sort of illness. According to a Princeton University Study, “on average, a person preoccupied with money problems exhibited a drop in cognitive function similar to a 13-point dip in IQ, or the loss of an entire night’s sleep.”1 That’s right – financial stress can actually temporarily lower a person’s IQ – and depending on how long this stressor is present in a person’s life, the impact can be huge. No employer wants their team members to go through this and although an individual’s well-being is an important factor, it’s not the only one. The impact it has on the rest of the team and the clients you serve may be immeasurable. While it is true that a healthy organization should care for their employees with adequate pay, growth plans and pay increases- let’s be real. No matter how much an employee is paid, they can still find themselves in stressful financial situations if they don’t have the proper tools to manage their personal finances well. We live in a world where want is often confused with need and where a large percentage of lottery winners (we’re talking millions and billions of dollars in winnings) file for bankruptcy. Although we know that all life’s issues (financial or otherwise) can’t be avoided, we want to equip our team with as many tools as possible to increase their opportunity for success on the job and in their personal lives. For this reason, we’ve realized that we can’t stop with developing our team on a professional level, we’ve got to go further and provide opportunities for development on a personal level as well. Although it’s less common to dig into the personal, it doesn’t have to be off limits, especially if you make participation intriguing, optional and accessible. To make personal development programs work for your team be sure you:

- Believe in the program you’re providing for your team. Find something that has shown results and is well worth the time invested.

- Sell it! Make participation sound exciting! Present the opportunity with energy and sell it!

- Cover the cost of participation but be sure to communicate the expectation that they will participate in the entire program. You can iron out your own guidelines for this.

- Time it right. Choose a time that will work for the majority of your team and is consistent (starting as soon as the work day ends can be the most effective).

- Have a point person for communication with the facilitator to organize details. People are attracted to participate in programs that are well organized.

- Celebrate successes from the program! These will re-affirm the value for those who participated and will entice others to participate in future opportunities.

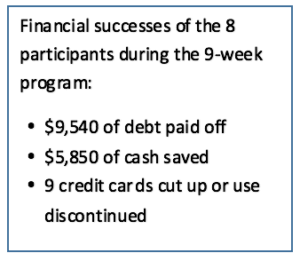

Financial Peace University at Clever Ducks: Financial Peace University (FPU) was a program our leadership was familiar with and that has proven extremely effective for the 2,700,000 families that have gone through it. According to Daveramsey.com, these families experience an average turnaround of $8,000 per family in the first 90 days. Our CEO, Peter Kardel, presented the opportunity in our team meeting, leading with some intriguing statistics and shared that he had gone through the program and personally experienced its value. Clever Ducks covered the cost to participate and even invited spouses to join in. As point person on the organizational details, I found the best day and time for all interested participants, connected with our facilitator to order participant toolkits and coordinated details throughout the 9 weeks, updating the team when needed. We plan to share the successes of the program at our upcoming team

We plan to share the successes of the program at our upcoming team  meeting. These successes included, building team unity, personal financial breakthroughs, and company culture building. In the class we got to learn more about each other’s personal goals and sift through some of our individual challenges with financial management. As an employee that is still fairly new to the team, the experience made me feel more connected to those who participated and strengthened my sense of belonging. The program also helped to build our culture by making employees feel invested in and cared for. This is one of the many ways we make being a duck bigger than clocking in and pouring out, we want the team to feel poured into as well with our weekly exercise class, healthy snack program, growth plans and more to come.

meeting. These successes included, building team unity, personal financial breakthroughs, and company culture building. In the class we got to learn more about each other’s personal goals and sift through some of our individual challenges with financial management. As an employee that is still fairly new to the team, the experience made me feel more connected to those who participated and strengthened my sense of belonging. The program also helped to build our culture by making employees feel invested in and cared for. This is one of the many ways we make being a duck bigger than clocking in and pouring out, we want the team to feel poured into as well with our weekly exercise class, healthy snack program, growth plans and more to come.

If you are interested in becoming a client of Clever Ducks for business IT services, please call 805.543.1930 or use the form to tell us how to contact you.

Need help with your Business IT?

Let’s talk. If we’re not the best fit, we’ll refer you to someone who is: Contact Us.